Sbi Fixed Deposit Interest Rates 2019

Get details on SBI Bank Loan Against Fixed Deposit ✔ Interest Rates ✔ Processing Fee ✔ Loan Amount ✔ Tenure ✔ Margin ✔ Features ✔ Benefits.

Single account holder can avail overdraft TDR and STDR online through internet banking, avail loan upto 90% of deposit. Loan amount for online overdraft against FD is Rs 25000 to Rs 5 Crore.

Table of Contents

SBI FD Calculator: State Bank of India Fixed Deposit Interest Rate Calculator 2019 Bank Fixed Deposits (FDs) are the safest forms of investment. They are not only risk-free but also flexible as banks allow you to withdraw the amount prematurely when in need. The current highest fixed deposit rate is a State Bank of India board rate The current Money Lobang National Average Fixed Deposit Rates for March 2021 is 0.46% p.a. The average monthly highest fixed deposit rate for State Bank of India since 2018 is 1.08% p.a. The last time State Bank of India had a fixed deposit rate promotion was in Jun 2019.

- 1 SBI Loan Against Fixed Deposit Details

SBI Loan Against Fixed Deposit Details

Fee & Charges of SBI Loan Against Fixed Deposit

| Interest Rate | 1% above the relative time deposit rate. |

| Amount of Loan | Minimum Rs 25000 to Maximum Rs 5 Crore. |

| Processing fee | Nil. |

| Repayment Period | Upto 5 years. |

| Margin | Avail loan up to 90% of your Time Deposit value. |

| Type of loan | Demand Loan & Overdraft. |

Eligibility to Avail SBI Loan Against Fixed Deposit

Customers (Single/ Joint Account Holder) holding SBI’s TDR/STDR / RD / including NRE/NRO/RFC and FCNR(B) Deposit can avail this loan. Single Account Holder can also avail Overdraft against TDR and STDR online through Internet Banking platform.

SBI Loan Against Fixed Deposit Advantage

- Loan up to 90% of the value of term deposit.

- Both Demand Loan and Overdraft Facility as per your need.

- Low interest rates.

- Interest rate on a daily reducing balance.

- Zero processing charges.

- No prepayment penalties.

Important Points About Loan Against Fixed Deposit From SBI

- The tenor cannot exceed 5 years.

- You cannot avail loan/overdraft facility against tax-saving fixed deposit (with a lock-in of 5 years).

- Banks provide loans only against their fixed deposits.

- SBI minimum amount 25,000 has an upper cap at Rs 5 crore.

- Suitable repayment schedule will be fixed depending upon the repayment capacity of the borrower. Maximum repayment period upto 5 years against STDR/e-STDR and upto 3 years against TDR/e-TDR respectively for Overdraft availed online

FAQs

How much overdraft limit can be availed – The customer will be able to avail 90% of his e-STDR / STDR value and 75% of his e-TDR / TDR as Overdraft facility on the Internet banking platform. At Branch level the customer can avail 90% of his underlying security value as Demand Loan/ Overdraft facility.

Minimum and maximum overdraft limit – The minimum loan amount for availing overdraft facility is Rs 25,000 and maximum overdraft limit can be availed against your Fixed Deposits Rs 5 Crore.

Overdraft be availed in joint name – No, currently only Customer holding TDR/STDR/e-TDR/e-STDR with SBI in Single name only can avail the facility online. Joint Account Holders have to visit SBI Branches for availing facility.

Repayment period – The maximum repayment period overdraft against e-STDR / STDR is 5 years, maximum repayment period overdraft against e-TDR / TDR is 3 years (residual period which is less, subject to minimum of 6 months).

The State Bank of India is one of the oldest financial institutions in the nation making the same a bank with a huge market share. The SBI Fixed Deposit Scheme is known for its high returns and impressive interest rates. The SBI Interest rate is competitive, and it is one of the many reasons why the bank can go ahead and formulate investment schemes for its customers.

A flexible tenor period is offered by the SBI to its customers who are interested in its Fixed Deposit Schemes. An investor can choose to keep their money fixed with the bank anywhere between 7 days to 10 Years. The best part, market fluctuations will have no impact on the interest rate!

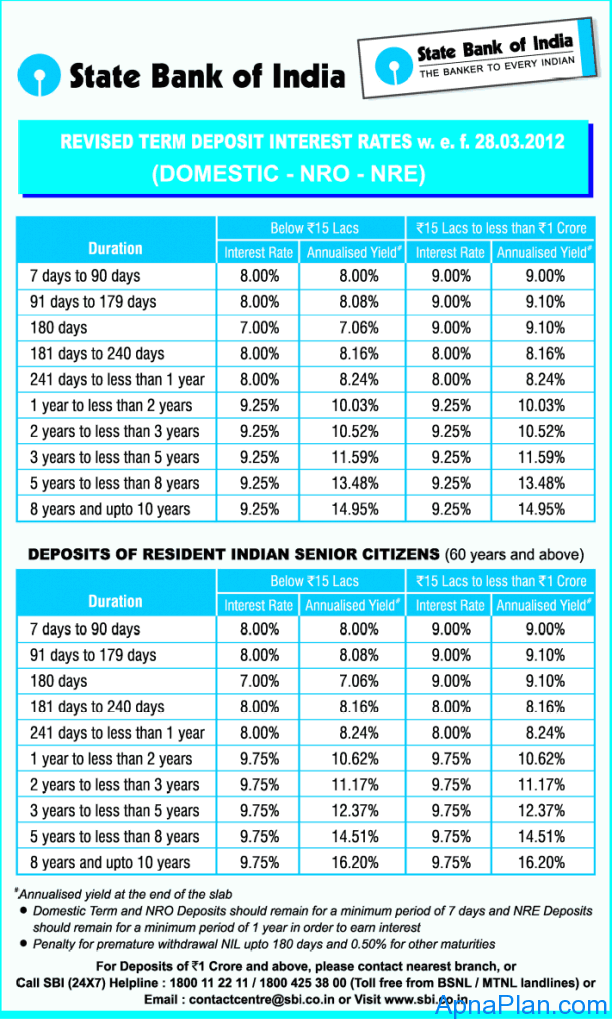

SBI Fixed Deposit Interest Rate

The interest rate for an FD is decided at the time it is taken. Though the pre-decided interest rate does not change over time, the tenor chosen for the FD does leave an impact. Thus, the SBI Fixed Deposit Interest Rate changes with the maturity period.

SBI’s FD schemes come with a variety of tenor

Tenure | SBI Regular FD Rates (Annually) |

| 7 – 45 Days | 5.75 Percent |

| 46 – 179 Days | 6.25 Percent |

| 180 – 210 Days | 6.35 Percent |

| 211 – 364 Days | 6.40 Percent |

| 1 Year | 6.40 Percent |

1 Year 1 Day – 1 Year 364 Days | 6.40 Percent |

| 2 Years – 2 Years 364 Days | 6.60 Percent |

| 3 Years – 4 Years 364 Days | 6.70 Percent |

| 5 – 10 Years | 6.75 Percent |

The longer the tenor of the FD, the higher is the interest rate offered by the bank

Sbi Fixed Deposit Interest Rates 2019

- The shortest permissible by the trusted bank is 7 days with the interest rates ranging from 5.25 to 7.25 per cent per annum. The benefit is compounded quarterly.

- Customers who want to avail the FD schemes for 2, 3 or 4 months can avail the same at an attractive interest rate of 6.5 per cent per annum.

- If a customer opts for a policy with a tenor of 6 to 9 months, they can enjoy an interest rate of 7 per cent per annum.

- The bank also offers medium and long-term tenors where the interest rates lie within the 7 per cent to 7.5 per cent bracket with the tenor range of 1 to 5 years.

Variations in Interest Rates

The State Bank of India is known for its competitive attitude. It provides its customers with an interest rate of:

- 5.75% – 6.75% for all customers

- Senior citizens are offered an additional 0.50% on the regular interest rates

- Ex-employees of the bank or current employees of the bank are provided with an additional 1 % on the existing interest rates as offered to the general population.

Though employees benefit from being a part of the SBI team, the government-controlled bank provides differential benefits to the elderly.

State Bank of India Senior Citizen FD Scheme

SBI offers high-interest rates on its Senior Citizen FD Scheme making it a popular investment vehicle among its senior citizen customers. An individual over the age of 60 years can either opt for the medium-term, short-term or long-term fixed deposit and enjoy an average SBI Senior Citizen FD Interest Rate that lies within the range of 6.25 per cent to 7.35 per cent per annum.

Tenure | SBI Senior Citizen FD Rates (Annually) |

| 7 – 45 Days | 6.25 Percent |

| 46 – 179 Days | 6.75 Percent |

| 180 – 210 Days | 6.85 Percent |

| 211 – 364 Days | 6.90 Percent |

| 1 Year | 6.90 Percent |

| 1 Year 1 Day – 1 Year 364 Days | 6.90 Percent |

| 2 Years – 2 Years 364 Days | 7.10 Percent |

| 3 Years – 4 Years 364 Days | 7.20 Percent |

| 5 – 10 Years | 7.25 Percent |

The tenor range offered by SBI for this scheme is from 5 – 10 years with a rate of return of 7.35 per cent per annum.

- If one chooses to invest in the scheme for 211 days to 1 year they will enjoy an interest rate of 6.90% per annum.

- Subsequently, if the investment is made for 1 to 2 years, an interest rate of 7.20 per cent per annum is provided.

- It rises to a whopping 7.30 per cent per annum if one keeps an FD for a tenor of 3 – 5 years.

Pensioners can benefit a lot from this FD scheme since it is a great source of supplementary income in the retirement years.

Knowing the different types of Fixed Deposits offered by the Bank is as just as important as knowing the tenor and interest rates offered.

State Bank of India FD Types

The SBI offers the following FD schemes to their customers:

- SBI Tax Saving Scheme

- Reinvestment Plan

- SBI MODS

- Annuity Deposit Scheme

- SBI Flexi Deposit Scheme

Sbi Bank Fixed Deposit Interest Rates 2019

Let’s Learn the Basics of Each of these FD schemes

- SBI Tax Saving Scheme

- Comes with tax benefits

- Customers investing in this scheme can avail tax benefits under the Section 80C of Income Tax Act, 1961

- The tenor is minimum of 5 years

- The fund cannot be withdrawn prematurely

- No overdraft or loan against the invested sum

- Minimum deposit is INR 1000 with an upper limit of INR 1,50,000

- Reinvestment Plan

- Ideal for those who want to make the most out of the compound interest factor on their FDs

- Interest will be paid to the customer only when the maturity period has arrived

- Minimum deposit is INR 1000 with no imposed upper limit

- Tenor period is minimum 6 months – maximum 10 years

- Loan, overdraft, premature withdrawal, auto-renewal and nominee facilities are available for this scheme

- SBI MODS

- It is the abbreviated form of Multi Option Deposit Schemes

- Linked with either a current a/c or a savings a/c

- Partial funds can be withdrawn at any point in time

- Remaining funds will earn interest as usual

- Minimum deposit under the scheme is INR 10,000

- Tenor period lies within the range of 1 – 5 years

- Annuity Deposit Scheme

- Guaranteed income against lump sum deposit made by the account holder

- Income is in the form of EMIs + interest earned

- Minimum deposit is INR 25,000

- SBI Flexi Deposit Scheme

- Does not require a lump sum deposit. Instead one can make several deposits at regular intervals

- Tenor period is a minimum of 5 years and a maximum of 7 years

- The minimum investment is INR 5,000 with an upper limit of INR 50,000/fiscal year

With so many things to be kept in mind while depositing in an FD, the most common question asked, “What is the amount I will receive at maturity?” Though the bank executive can help you, you can use the SBI online calculator.

The SBI FD Calculator

The SBI FD Calculator computes the amount a person will receive at the end of the tenor or on the maturity date. However, it is necessary to fill in the correct data to get the right approximation. Here is what the depositor needs to input:

- Principal amount or the total amount to be deposited – this is decided by the depositor. Any money not being used should be invested in a fixed deposit.

- The rate of interest – this is decided by the bank and will take into consideration age and tenor

- Compounding frequency – it can be mutually decided by the bank and depositor, though it may be unchangeable for certain FD schemes. It can vary from monthly, quarterly, or annually. Remember, the longer the compounding frequency period, the higher is the rate of interest earned

- Tenor – the period of time for which the money can be decided by the depositor. However, the Bank would have certain restrictions.

Keep in mind that the calculators are designed to give you an accurate amount, but slight variations can occur owing to schemes opted for and other factors.

The SBI or the State Bank of India is the largest bank of the subcontinent. Since it is government-controlled, its features, offers and interest rates are designed for the benefit of the citizens, but every deposit carries a higher safety value than any other. But, it is crucial to study all the SBI FD offers and schemes before reaching a decision.